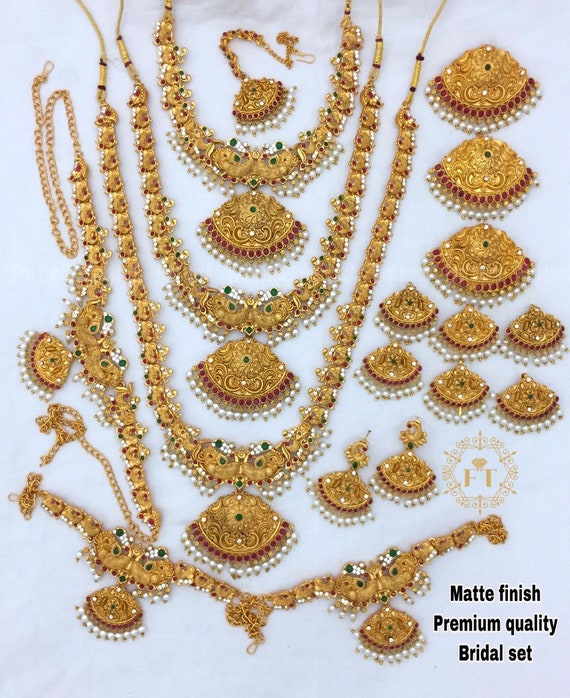

Understand the Benefits of Purchasing Gold Jewelry as a Financial Possession

Gold jewellery has actually long been viewed as more than plain adornment; it stands as a robust monetary possession with diverse advantages. Integrating gold jewellery right into a varied profile can alleviate risks linked with market changes. Past its monetary benefits, the nostalgic and cultural significance of gold jewelry adds layers of value.

Historical Worth Retention

Just how has gold managed to maintain its allure and value throughout centuries? The long-lasting appeal of gold can be connected to its innate top qualities and historic relevance.

Historically, gold has played a crucial function in economic systems as a tool of exchange and a criterion for money. This long-standing association with financial systems underpins its perceived stability and reliability as a store of worth. Unlike various other products, gold does not corrode or taint, which guarantees its long life and continual need.

Culturally, gold jewellery has actually stood for both individual accessory and a concrete possession that can be passed down through generations, maintaining wealth and custom. Its value retention is further reinforced by its universal recognition and acceptance, transcending geographic and cultural borders. These qualities jointly add to gold's capability to keep its allure and relevance as a beneficial economic property gradually.

Bush Versus Rising Cost Of Living

Gold jewelry offers as a reliable inflation-hedge, supplying protection versus the abrasive impacts of rising prices. As inflation erodes the acquiring power of money, substantial properties like gold maintain their innate worth, making them a trusted shop of wide range. Historically, gold has actually shown resilience throughout periods of economic instability, as its cost usually rises in feedback to inflationary pressures. This characteristic makes gold jewelry not only an icon of high-end however also a calculated economic property for maintaining riches in time.

Unlike fiat money, which can be subject to control and devaluation by governments, gold's worth is inherently stable. Capitalists looking for to diversify their profiles often turn to gold jewellery to counter the risks connected with money devaluation and economic turmoil.

Easy Liquidity Choices

Among the substantial advantages of purchasing gold jewellery is its simple liquidity. Unlike many other types of investment, gold jewelry can be rapidly converted right into cash. This characteristic renders it an optimal choice for people seeking a financial asset that can be easily accessed throughout times of urgent demand. The worldwide market for gold guarantees that there is always a demand, which helps with smooth transactions. Gold jewellery can be marketed or pawned at regional jewellery shops, pawnshops, or via on-line systems, offering several methods for liquidation.

Jewelry items are typically appraised based on their weight and pureness, with the present market rate for gold determining their cash value. The appeal of gold jewellery in social and economic contexts worldwide enhances its resale worth, making sure that it stays a robust monetary property.

Profile Diversification

Incorporating gold jewellery right into an investment portfolio can use significant diversification benefits. This valuable steel commonly behaves differently from various other property courses, such as stocks and bonds, which are susceptible to market volatility and financial changes. Gold's one-of-a-kind residential or commercial properties permit it to work as a hedge versus inflation and currency variations, therefore providing stability when conventional properties fail. By incorporating gold jewelry, investors can alleviate threats and potentially boost the general efficiency of their portfolios.

Gold jewelry is not click to investigate just a tangible property but also keeps intrinsic worth, independent of financial market problems. Unlike paper possessions, which can become worthless in extreme situations, gold has a historical reputation for protecting wide range. Its innate value continues to be fairly stable, providing a trusted store of value gradually. This stability is particularly attractive during periods of financial unpredictability or geopolitical stress, when investors look for safe-haven properties.

Moreover, gold jewelry's international charm and demand ensure liquidity, enabling investors to promptly transform their holdings into money if needed. This liquidity can be critical for rebalancing profiles or confiscating new reference financial investment chances. Ultimately, including gold jewellery provides a critical advantage, enhancing profile durability and fostering long-lasting monetary safety and security.

Cultural and Nostalgic Worth

The nostalgic and social value of gold jewelry is a substantial element that establishes it apart from other kinds of investment. Unlike bonds or stocks, gold jewellery usually goes beyond plain financial worth, embodying deep-rooted social traditions and individual memories.

Additionally, gold jewellery frequently brings emotional worth, passed down via generations as cherished treasures. These items can stimulate familial and personal histories, acting as substantial links to the past. The psychological accessory connected with gold jewelry can make it a treasured property, valued not merely for its monetary well worth but also for its capability to protect and communicate household narratives and practices.

Verdict

Spending in gold like it jewelry provides substantial advantages as a monetary property. Gold's historic worth retention and its duty as a bush against inflation provide security in uncertain financial conditions. Its high liquidity ensures speedy conversion to cash, enhancing financial versatility. Diversification with gold jewellery reduces direct exposure to standard market dangers. Moreover, the sentimental and social worth connected to gold items improves their financial investment allure, making them a significant enhancement to both economic portfolios and family members traditions.

Past its economic advantages, the sentimental and cultural value of gold jewelry includes layers of value (gold jewellery dubai). Gold jewellery can be sold or pawned at local jewelry stores, pawnshops, or with on-line systems, providing multiple opportunities for liquidation

The popularity of gold jewellery in financial and cultural contexts worldwide boosts its resale worth, guaranteeing that it remains a robust financial asset.

Gold jewelry is not just a tangible asset yet additionally retains intrinsic worth, independent of economic market conditions. The psychological attachment associated with gold jewellery can make it a treasured asset, valued not merely for its financial worth yet for its capacity to communicate and protect household stories and customs.